Affiliate Disclosure: Travel with Plastic may earn a commission or referral bonus from some links on this site. These affiliate links help support our work and may influence the placement or promotion of certain products or services. However, our content is independently crafted to reflect honest opinions. Not all offers or products are included. There is no additional cost to users when they utilize our affiliate links.

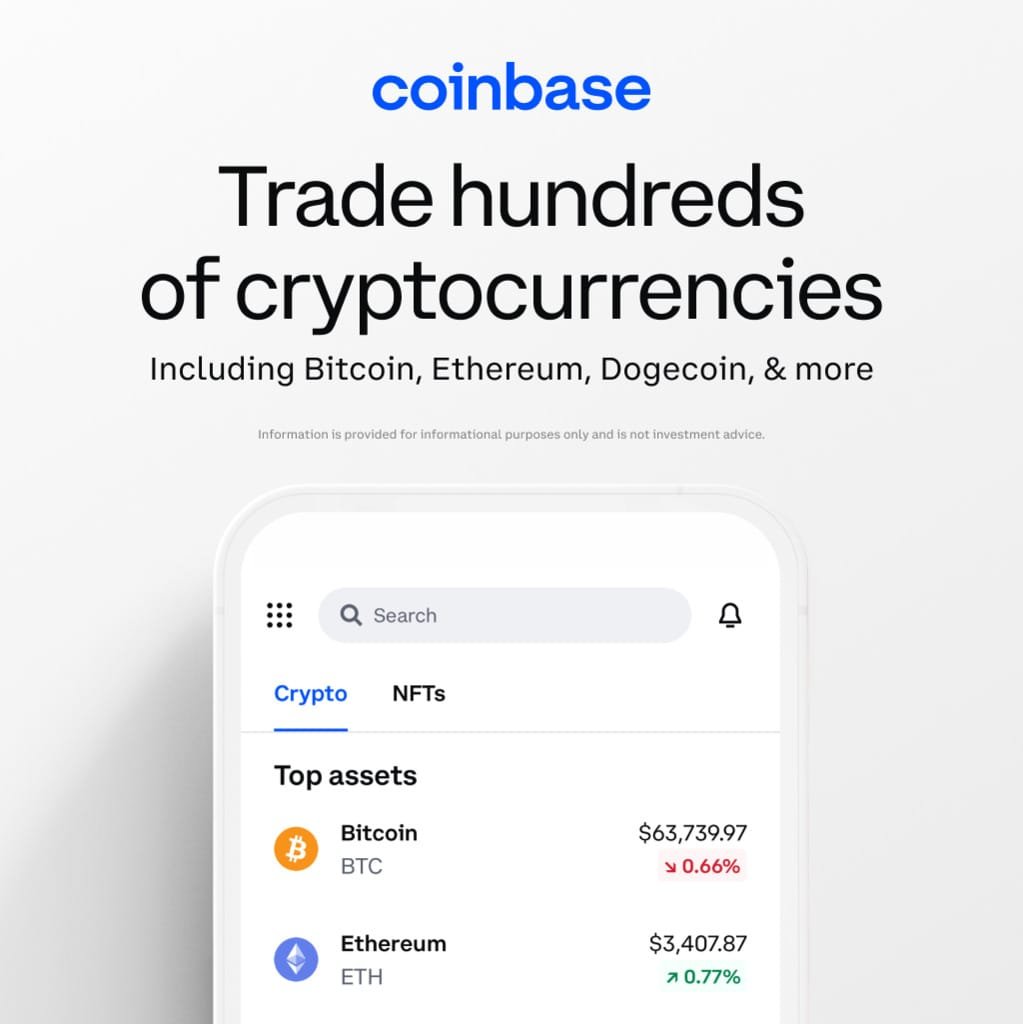

A 2021 Pew Research Center study revealed that 16% of Americans have tried cryptocurrency. This shows digital currencies are becoming more popular. Travelers are finding new ways to fund their trips using platforms like Coinbase.

Cryptocurrency travel options are growing fast. Over 600 airlines now accept Bitcoin through Alternative Airlines. Expedia has been taking crypto payments since 2014. Coinbase, a top cryptocurrency exchange, offers an easy way to manage travel finances.

Airbaltic lets you book flights to 70+ destinations using your Coinbase travel wallet. Bitcoin.Travel offers 2,000 cryptocurrencies for bookings. These options show how versatile crypto can be for travel.

Key Takeaways

- 16% of Americans have experience with cryptocurrency

- Over 600 airlines accept Bitcoin payments through Alternative Airlines

- Expedia has been crypto-friendly since 2014

- Coinbase offers a secure platform for managing travel finances

- Crypto payments provide access to a wide range of travel options

- Digital currency vacations offer flexibility and potential cost savings

Understanding Coinbase as Your Travel Finance Platform

Coinbase leads in bitcoin tourism and decentralized travel finance. It offers over 200 cryptocurrencies for trading. This versatile platform provides alternative payment methods for travelers.

What Makes Coinbase Ideal for Travel Transactions

Coinbase excels in blockchain travel bookings. Its user-friendly interface and $2 account minimum appeal to new crypto users. The platform’s spread fees are competitive, typically around 0.5%.

- Over 200 cryptocurrencies and stablecoins available

- Earn up to 5.75% APY through staking

- USD 312 billion in quarterly trading volume

Setting Up Your Coinbase Account for Travel

Creating a Coinbase travel account is easy. The platform offers three types of online wallets for different security needs. Coinbase provides a Visa debit card, accepted wherever Visa is used.

Security Features and Protection Measures

Coinbase prioritizes security in the volatile crypto world. They store 98% of customer funds offline to protect against cyber threats. U.S. dollar deposits are held in FDIC-insured bank accounts.

- 24/7 global security monitoring

- Advanced attack surface management

- Sophisticated red teaming capabilities

Coinbase offers a secure platform for managing travel finances. Its features cater to the evolving landscape of cryptocurrency.

Getting Started with Cryptocurrency for Travel

Crypto travel offers exciting possibilities for smart globetrotters. There are over 15,000 cryptocurrencies available today. Bitcoin, the largest, has grown tenfold in five years, making it attractive for travel funds.

Coinbase crypto rewards are a great entry point. You can earn crypto while learning about its travel potential. This knowledge helps when exploring crypto-friendly destinations.

Beginners should start small. Most exchanges allow minimum trades of $5 to $10. Cryptocurrencies are risky investments. Invest no more than 10% of your portfolio in high-risk assets like crypto.

Research destinations where you can use digital currencies directly. This approach can help avoid currency exchange fees. It may also increase your travel funds’ value.

As you learn more, crypto travel can enhance your journey. It offers financial benefits and a modern travel experience. Explore the world of digital currencies and unlock new travel opportunities.

Crypto for Travel: How to Use Coinbase to Fund Your Next Trip

Discover how to use crypto for travel with our Coinbase guide. This platform supports over 260 cryptocurrencies, perfect for globetrotters. Let’s explore crypto travel hacks for a smoother, cost-effective journey.

Converting Crypto to Travel Currency

Coinbase makes turning digital assets into spendable cash easy. It supports over 30 countries for converting crypto to local currency. For transactions above $200, Coinbase applies a 0.5% spread mark-up.

Managing Exchange Rates and Fees

Know Coinbase’s fee structure to save money. Small purchases under $10 have a flat fee of $0.99. Larger transactions can cost up to 3.99% for debit card purchases.

Use your U.S. bank account or Coinbase USD wallet for lower fees. These options charge only 1.49% for transactions over $200.

Timing Your Conversions for Better Rates

Convert crypto to travel money at the right time. Watch market trends and exchange rates closely. Bank account transfers take 3 to 5 business days, so plan ahead.

Need money fast? Instant card withdrawals are available. But remember, they come with a fee of up to 1.5% per transaction.

Master these Coinbase travel hacks for your next trip. Use crypto for flights, hotels, or spending money with this flexible solution.

Booking Flights and Hotels with Cryptocurrency

Crypto travel is gaining popularity. More platforms now accept digital currencies for bookings. Let’s see how you can use crypto for your next trip.

Popular Travel Platforms Accepting Crypto

Several travel websites now welcome cryptocurrency payments. Travala offers flight bookings to 230 countries at competitive prices. CheapAir, the first online travel agency to accept various cryptocurrencies, has sold millions of fares.

Expedia has been accepting Bitcoin payments since 2014. These platforms make it easier for travelers to use their digital assets.

| Platform | Crypto Accepted | Services |

|---|---|---|

| Travala | Multiple | Flights, 2.2M+ properties, 400K+ activities |

| CheapAir | Bitcoin, Litecoin, Bitcoin Cash, Dash | Flights, hotels, car rentals |

| Expedia | Bitcoin (via Coinbase) | Flights, hotels, vacation packages |

Using Coinbase for Travel Reservations

Coinbase simplifies converting crypto to cash for travel. You can use the Coinbase Card for direct purchases. Or, transfer funds to your bank account.

To book, convert your crypto to the needed currency. Then complete the transaction with ease.

Maximizing Rewards and Cashback

Many crypto-friendly travel platforms offer rewards programs. Travala’s AVA Smart Program gives discounts and loyalty rewards. Some users convert crypto to miles for extra benefits.

Compare rates and rewards across platforms. This helps you get the best deal for your crypto travel budget.

Using cryptocurrency for travel avoids international fees and card charges. Blockchain transactions complete quickly, giving faster booking confirmations. Start planning your crypto-funded getaway today!

The Coinbase Card: Your Travel Companion

The Coinbase Card transforms travel with bitcoin and other cryptocurrencies. This Visa debit card links your digital assets to real-world spending. It’s a must-have for crypto fans and globe-trotters.

The card supports over 200 cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin. You can use your crypto or USD balance at millions of Visa-accepting locations worldwide.

New to Coinbase? No problem. Set up your account and apply for the card easily. You’ll soon enjoy its perks, including crypto rewards on purchases.

| Feature | Benefit |

|---|---|

| Crypto Support | 200+ cryptocurrencies |

| Acceptance | Millions of locations worldwide |

| Rewards | Earn crypto on purchases |

| Security | 98% of funds in cold storage |

The Coinbase Card shines among crypto debit cards. It integrates smoothly with the Coinbase platform. With millions of users, it’s changing how we travel with cryptocurrency.

Managing Travel Expenses with Crypto

Crypto opens up new ways to manage your travel expenses. Tools like Coinbase help you track spending and quickly redeem crypto when needed. This makes budgeting easier and more flexible.

Budgeting with Digital Currency

Crypto allows for real-time budget tracking while traveling. Coinbase’s interface helps you monitor spending in various currencies. You can set alerts for price changes to make smart exchange decisions.

Emergency Fund Management

Keep some travel funds in stablecoins like USDC or USDT. These maintain value relative to the US dollar, providing a reliable emergency fund. If surprises occur, you can quickly cash out on Coinbase for local currency.

Transaction Tracking and Records

Coinbase offers detailed transaction history for budgeting and taxes. Every crypto redemption and purchase is recorded, showing your travel spending clearly. This helps when dealing with multiple currencies during your trip.

| Expense Type | Tracking Method | Benefits |

|---|---|---|

| Accommodation | Coinbase transaction history | Easy categorization, instant conversion rates |

| Transportation | Coinbase card purchases | Automatic expense logging, rewards accumulation |

| Food and Dining | Mobile app expense tracking | Real-time budget updates, category-specific limits |

Crypto-based tools help you control your travel budget better. They can help you avoid money troubles while exploring new places. With these tools, you can focus on enjoying your trip.

International Travel Considerations

Crypto brings new opportunities for international travel. Platforms like coinbase.com let you earn crypto for travel. This simplifies financial transactions abroad.

Crypto-Friendly Destinations

Some countries are more welcoming to cryptocurrencies. Over 2 million accommodations worldwide accept Bitcoin through Travala. Cheapair lets you book flights, hotels, and car rentals with Bitcoin.

Local Currency Conversion Tips

Efficient crypto-to-local currency conversion is vital. Coinbase supports various currencies like USD, EUR, and GBP. Using a crypto debit card is a taxable event.

Regulatory Compliance Abroad

Know the crypto rules at your destination. As of April 2023, 35 out of 135 jurisdictions have Travel Rule legislation. This rule requires information for transfers over 1,000 USD/EUR.

In the EU, regulations will apply to all transactions from December 30, 2024.

| Country | Travel Rule Implementation | Threshold |

|---|---|---|

| European Union | From Dec 30, 2024 | No threshold |

| Singapore | Jan 28, 2020 | SGD 1,500 |

| Estonia | Implemented | Not specified |

Understanding these factors will help you use cryptocurrency confidently during your travels. Be prepared and enjoy your global adventures with digital currencies.

Maximizing Travel Rewards with Crypto

Crypto opens new doors for earning and using travel rewards. It can boost your vacation fund and unlock exciting perks. Let’s explore using Coinbase to fund trips and maximize rewards.

Coinbase offers staking options to earn passive income on your crypto. Some coins yield up to 5.75% annually. This can grow your travel fund while you hold digital assets.

The Gemini Credit Card is great for crypto fans planning trips. It gives 4% back on gas and EV charging (up to $200 monthly). You also get 3% on dining and 2% on groceries.

These rewards can be redeemed across more than 50 cryptocurrencies. This gives you flexibility in funding your travels.

The Venmo Credit Card offers up to 3% cash back in your top spending category. You can convert rewards into popular cryptocurrencies like Bitcoin and Ethereum. This makes it easier to save for crypto travel adventures.

- Stake your crypto on Coinbase to earn passive income

- Use crypto-friendly credit cards to earn rewards on everyday purchases

- Convert cashback rewards into cryptocurrency for potential growth

- Explore travel loyalty programs that integrate with digital currencies

These strategies can stretch your travel budget further. You can enjoy luxurious experiences without spending more. Use crypto for travel and watch your rewards grow as you plan trips.

Conclusion

Cryptocurrency has changed how we fund our trips. Platforms like Coinbase offer secure travel wallets, expanding the world of bitcoin tourism. Crypto provides a flexible alternative to traditional currency for booking flights and managing expenses.

Altcoin travel payments offer unique benefits. These include swift transactions and lower fees. The Coinbase Card bridges digital and fiat currencies, allowing crypto use worldwide.

It’s important to stay informed about tax and regulatory compliance in different countries. The future of crypto in travel looks promising. More travel platforms are accepting digital currencies.

The total market cap of cryptocurrencies has reached $2.4 trillion. This suggests increased adoption and innovation in the space. Using digital currencies in your travel strategy could lead to a more rewarding journey.