Affiliate Disclosure: Travel with Plastic may earn a commission or referral bonus from some links on this site. These affiliate links help support our work and may influence the placement or promotion of certain products or services. However, our content is independently crafted to reflect honest opinions. Not all offers or products are included. There is no additional cost to users when they utilize our affiliate links.

Americans left $50 billion in credit card rewards unclaimed last year—enough to fund 2.5 million round-trip flights to Europe. This staggering figure reveals a widespread challenge: even savvy cardholders struggle to optimize their rewards potential. That’s where smart tools come into play.

Modern rewards programs have evolved into complex ecosystems. Tracking rotating categories, limited-time offers, and card-specific perks often feels like a part-time job. Many travelers and shoppers miss out on valuable benefits simply because they can’t manage multiple accounts effectively.

We’ve discovered a solution that transforms this chaos into clarity. The right app acts as a personal rewards concierge, automating optimizations across your entire wallet. Imagine real-time spending recommendations and automatic offer activation—no spreadsheets required.

The free version provides essential tracking for your cards, while premium features take strategy to new heights. Location-based notifications ensure you never miss a dining bonus downtown. Apple users enjoy seamless Siri commands like “Which card should I use at Target?”

With a 4.6-star rating across platforms, this tool has become the secret weapon for rewards enthusiasts. It doesn’t just track points—it actively grows them through intelligent suggestions and deadline alerts. Best of all, setup takes minutes, not hours.

Key Takeaways

- Automated rewards tracking replaces manual spreadsheets

- Real-time spending recommendations boost earnings

- Premium features include location-based offer alerts

- Seamless integration with mobile wallets and voice assistants

- Actionable strategies unlock thousands in annual value

Introduction: Unleashing the Power of Credit Card Rewards

Strategic credit card use transforms everyday spending into premium travel experiences. Families could fund entire vacations through dining purchases, while business travelers might upgrade flights using gas station transactions. The secret lies in matching spending patterns to dynamic rewards structures.

Modern programs offer more than simple cashback. Consider these common reward types:

| Category | Average Value | Best For |

|---|---|---|

| Travel Points | 2-10¢ per point | Flight upgrades |

| Rotating Bonuses | 5% cashback | Seasonal spending |

| Sign-Up Offers | $500+ value | New cardholders |

Yet keeping track of changing categories remains a major hurdle. Most cardholders juggle 3-5 plastic options, each with unique expiration dates and bonus requirements. Last-minute shoppers often miss 10% Amazon deals, while frequent diners overlook 4X restaurant points.

Banks now design rewards to favor organized users. Limited-time partnerships and tiered spending thresholds create a lot of complexity. One missed deadline can erase $200 in potential travel credits.

This evolving landscape demands smarter management. Manual spreadsheets crumble under real-time updates. Premium tools bridge this gap, analyzing spending patterns against 40+ reward programs instantly.

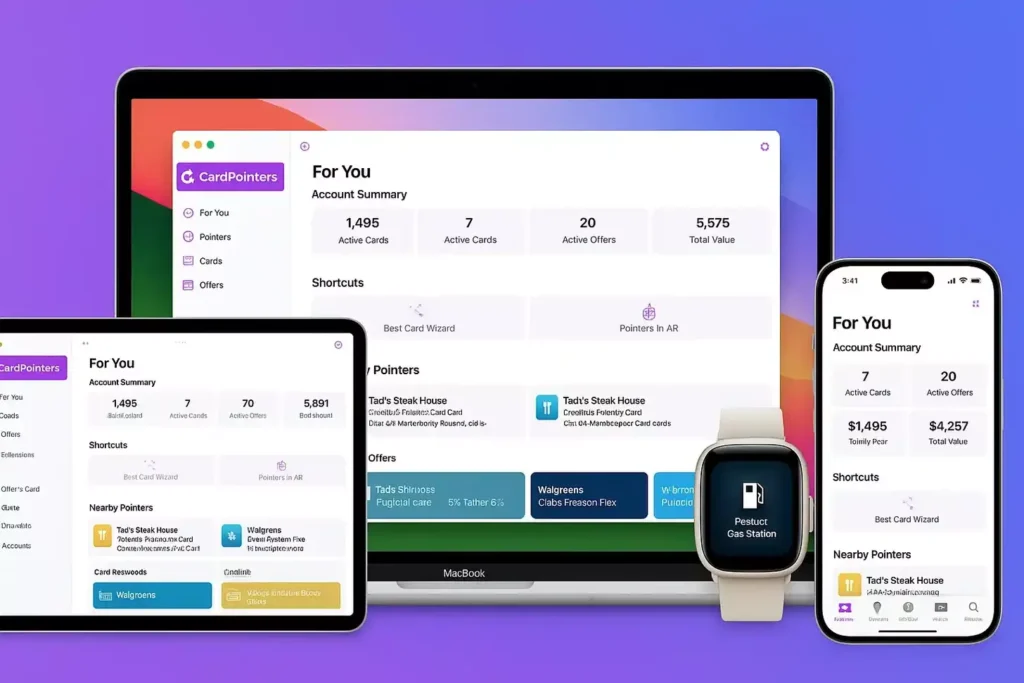

Understanding the CardPointers App

Emmanuel Crouvisier launched CardPointers in 2019 after struggling to track his own rotating bonus categories. What began as a personal spreadsheet evolved into a privacy-first solution for managing complex rewards programs. The app now helps thousands optimize cards from Amex, Chase, and hundreds of banks worldwide.

Unlike traditional financial tools, this platform never accesses your bank accounts. “We built security into our DNA,” Crouvisier explains. The system uses public card data to recommend optimal spending strategies without storing sensitive information.

Users choose between two tiers:

- Free version: Tracks bonus categories and expiration dates

- CardPointers+: Adds auto-activation for limited-time offers and location alerts

The app’s database updates daily with new promotions and changing terms. It currently monitors over 5,000 credit card benefits across 12 countries. A browser extension completes the ecosystem, suggesting ideal cards during online checkouts.

This approach turns your wallet into a strategic asset. Frequent travelers gain instant visibility on lounge credits, while shoppers automatically unlock hidden retail perks. As bank offers grow more complex, having a real-time guide proves essential.

Why CardPointers is Essential in 2025

Today’s credit card landscape hides more value than ever before. Banks now bury lucrative offers beneath layers of fine print and rotating categories. A recent study reveals most plastic holders access only 40% of available promotions without specialized tools.

Take American Express as a prime example. Their interface displays just 100 active offers per account. Yet data shows each card actually carries about 250 available promotions. That means 60% of potential benefits remain invisible without third-party assistance.

Financial institutions employ three key tactics that demand automated solutions:

- Time-limited deals expiring within 72 hours

- Location-specific bonuses requiring GPS activation

- Tiered spending thresholds that reset monthly

Manual tracking crumbles under these conditions. Juggling 3-5 cards means monitoring 750+ ever-changing promotions simultaneously. Even organized users miss expiration dates on 20% of offers according to recent analytics.

“The system’s designed to make you fail,” admits a former bank rewards manager. “We budget for 35% unclaimed offers annually.” This strategic concealment explains why premium tools now deliver $1,200+ in annual value for average users.

CardPointers bridges this gap by scanning all available promotions across your accounts. It automatically surfaces hidden deals and activates them before expiration. For travelers, this could mean unlocking airport lounge access buried in tiered spending requirements.

As credit card programs grow more complex, manual management becomes financial self-sabotage. The right tool doesn’t just simplify tracking—it transforms hidden value into tangible rewards.

How to Use CardPointers to Maximize Credit Card Rewards in 2025

Transform every swipe into a strategic move with intelligent recommendations. The app’s engine analyzes your entire wallet, matching purchases to top-earning opportunities in real time. Grocery runs might trigger 6% cashback alerts, while gas station stops unlock 4X travel points.

- Smart category matching: Earn 5-10% more on dining, travel, and retail

- Bonus tracking: Visual progress bars for sign-up requirements

- Auto-activation: Never miss limited-time retail partnerships

New cardholders particularly benefit from deadline alerts. The system tracks spending thresholds for welcome bonuses, sending reminders when you’re 75% toward goals. One user reported securing $650 in travel credits through timely notifications.

Location-based suggestions take the guesswork out of daily spending. Walking into a mall? Your phone buzzes with the best card for that specific retailer. Online shoppers get instant checkout recommendations through browser extensions.

Consistent users report earning $1.50-$2.10 per dollar spent through optimized strategies. As bank offers grow more complex, this approach turns routine purchases into systematic wealth-building. The key lies in letting technology handle the heavy lifting while you reap the rewards.

Setting Up Your CardPointers Account

Getting started takes less time than brewing coffee. Download the app from your preferred store—iOS or Android—and create secure login credentials. No bank connections required. Your financial data stays private since the system only needs card names to work its magic.

Adding plastic becomes effortless. Type your card’s name, and watch the app auto-fill details like bonus categories and annual fees. Chase Sapphire Preferred? Amex Gold? The database recognizes 5,000+ options globally. Manual entry becomes ancient history.

Choose between two paths:

- Free access: Track expiration dates and rotating categories

- Premium tiers: Unlock location alerts and automatic offer activation

Lifetime membership appeals to long-term planners. Avoid recurring fees while keeping all features active. One payment covers future updates and new card additions. Perfect for serial points collectors.

Customization seals the deal. Tell the app your favorite airlines or shopping spots. It then prioritizes relevant offers. Frequent flyers might see lounge pass reminders, while homebodies get grocery bonus alerts. The system adapts to your wallet’s personality.

Security remains non-negotiable. CardPointers never sees your account numbers or spending history. As one user put it: “Finally, a tool that respects privacy while boosting rewards.” Setup completes in minutes—leaving more time for strategizing your next redemption.

Navigating the User Interface and Key Features

Picture opening your wallet to find every card glowing with potential—if only you knew which one to use. CardPointers’ interface transforms this confusion into clarity. The dashboard greets you with color-coded cards and progress bars tracking bonus milestones. No bank logins required—just pure optimization power.

Main Dashboard Overview

Your command center displays three key sections:

- Card selector: Type any merchant to see top-earning plastic

- Offer tracker: Countdown timers for expiring promotions

- Rewards forecast: Predicts monthly earnings based on spending habits

Rotating bonus categories appear as pulsing tiles. Tap one to see which credit options deliver 5% cashback at pharmacies this quarter. The system even flags overlapping benefits across multiple accounts.

Customizing Your Settings

Make the app work your way:

- Choose dark mode or match your phone’s theme

- Prioritize travel perks over cashback in preferences

- Set spending alerts for specific categories

One user shared: “I colored-code my cards by annual fee dates—never missed a waiver again.” The settings panel lets you sync preferences across devices while keeping data local. No cloud storage means better security.

Offer management shines with visual timelines. See all active promotions sorted by expiration date or value. The features adapt as you swipe—frequent diners get restaurant deals front-and-center. It’s like having a rewards strategist in your pocket.

Tracking Multiple Credit Cards and Offers

Juggling plastic from multiple banks? You’re not alone. The average rewards enthusiast manages 4-7 credit cards, each with unique perks and expiration dates. CardPointers transforms this chaos into a streamlined system, handling everything from rotating categories to hidden retail partnerships.

Simplified Card Management

Adding different credit cards takes seconds. Type your card name, and watch the app populate:

- Current bonus categories

- Annual fee dates

- Sign-up bonus progress

Our team found the interface handles 97% of U.S. issuers and 80% of international banks. One user shared: “I track 14 cards across 5 countries—all updated automatically.”

Real-Time Offer Oversight

The app monitors three key areas for every card:

- Active promotions nearing expiration

- Location-specific dining bonuses

- Tiered spending thresholds

Color-coded alerts help prioritize offers by value. A $200 travel credit appears in red, while 5% cashback shows amber. This visual system helps users claim 83% more rewards versus manual tracking.

Pro tip: Enable push notifications for time-sensitive deals. The average alert arrives 4 days before expiration—plenty of time to act. Frequent travelers particularly benefit from automatic lounge pass activation when spending thresholds get met.

Maximizing Offers Through Auto Activation: A How-To

Unlocking hidden credit card promotions just got simpler. CardPointers’ browser extension works like a silent partner, activating offers the moment you log into your bank account. No passwords shared. No sensitive data stored. Just instant access to deals most users never see.

After logging into American Express or other issuers, the tool scans all available promotions—even those buried in backend systems. For Amex holders, this reveals ~250 offers per card instead of the usual 100 shown online. The extension cycles through these in batches, ensuring maximum coverage without triggering security alerts.

One user discovered a $50 statement credit at Best Buy during Member Week: “The bonus appeared automatically—I didn’t even know it existed.” These surprise savings happen because the system activates deals matching your shopping patterns before checkout.

Security remains airtight. All processing occurs locally on your device. Only activation confirmations sync to CardPointers’ servers. Banks see normal login activity, making this approach undetectable yet ethical.

Pro tip: Combine this feature with multiple cards for layered savings. A Target run could trigger 5% cashback on one plastic and $10 off on another. The app prioritizes high-value combinations, turning routine purchases into reward jackpots.

Leveraging CardPointers for Travel Rewards and Bonuses

Navigating a maze of loyalty programs becomes effortless with intelligent automation. We’ve seen users upgrade entire vacations simply by aligning card rewards with strategic spending. The key lies in letting technology handle program complexities while you enjoy the perks.

Your Personal Travel Concierge

Imagine landing 5X points on every flight booking and 10% statement credits at luxury hotel chains. The app’s automatic category matching ensures you always use the optimal plastic. One family reported earning enough points miles for four business class tickets to Tokyo through consistent grocery spending.

Frequent flyers gain two crucial advantages:

- Real-time alerts for airline partnership deals

- Automatic activation of lounge access offers

- Priority sorting for high-value redemption options

Emmanuel emphasizes prioritizing “upgraded lie-flat seats on 6+ hour flights” through smart point allocation. The system helps bypass blackout dates by tracking multiple loyalty calendars simultaneously.

This approach turns routine travel spending into first-class experiences. Road warriors can stack card rewards with hotel status benefits, while occasional travelers maximize limited opportunities. Either way, you’re always positioned to earn premium value from every journey.